About This Club

This club is dedicated for discussions related to Pakistan Stock Exchange Investments. I invest in stock market and could answer questions relating to investment in stock market if someone has any. If you were curious about what stocks are or if you want to invest yourself, ask anything that comes to your mind.

- What's new in this club

-

Engr. Muhammad Adnan joined the club

-

Zeeshan Ahmad joined the club

-

Nawaz Qasim joined the club

-

AQSA NEAZ joined the club

-

Ahsan Tariq joined the club

-

Hello, I came across this video yesterday. This is very useful if you are new to investing.

-

Rashid Ali joined the club

-

Kashif Salman joined the club

-

ANStructs joined the club

-

Muhammad Ameen Ali joined the club

-

Syed Uzair Ahmad joined the club

-

myasirkaram@gmail.com joined the club

-

imranjam joined the club

-

Engr Sajid naeem joined the club

-

Muhammad Azeem joined the club

-

Junaid Farooq Janjua joined the club

-

SALMAN CH joined the club

-

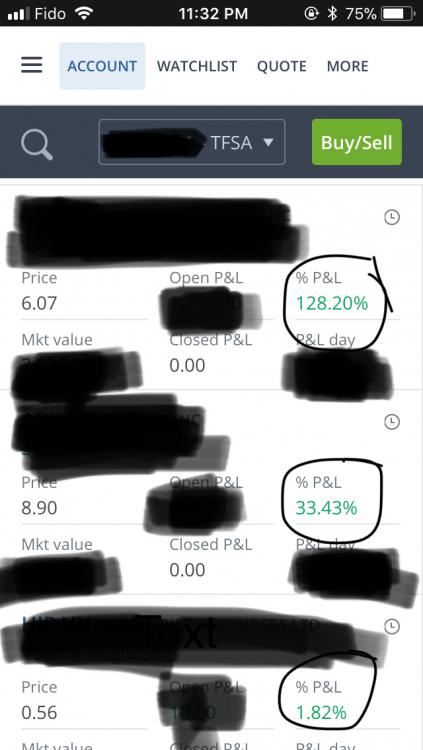

Practicing engineering helps us put food on table.. being an engineer is what will make us wealthy! Being an engineer means being smart in every aspect of life.. Might be little narcissistic but I wanted to share my recent run on stocks! Enjoy and good luck to y’all as well!

-

Shafqat HUSSAIN joined the club

-

-

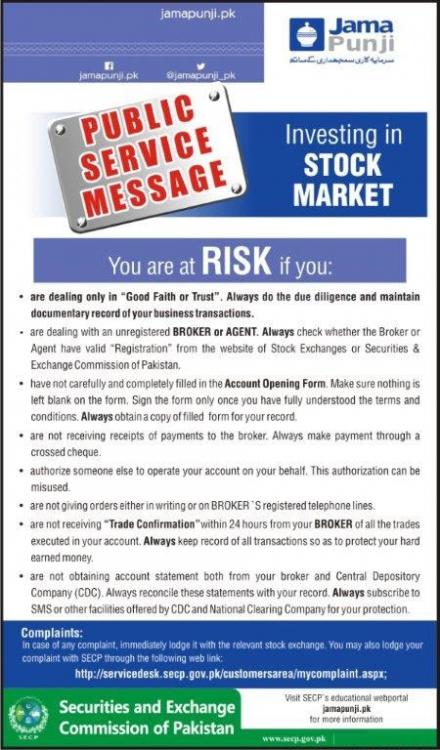

The securities and exchange commission of Pakistan has established an excellent resource for investor education. The website is: http://www.jamapunji.pk Please do check it out as it contains a lot of useful infomration. Thanks.

-

Waqas Haider joined the club

-

Minimum Investment and Return

UmarMakhzumi replied to Waqar Saleem's topic in PSX Stocks Investing's Topics

Spot on! -

I had a wonderful experience doing forex which I later quit. I am not into stocks but I think the same rules will apply here; 1. The most important thing is to 'be patient'. And by this I mean really be patient. Its a game of nerves. 95% people in forex lose because they are impatient. 2. Always be up to date with latest trends and news, i mean on daily basis. Don't just buy and then sleep. Get familiar with different types of predictors, study the mathematics behind different charts such as Fibonacci retracement. 3. Mix the risk levels. Don't just play only on high risk deals. Now coming back to your question. The minimum investment depends on your goals. Short term or long-term? Risk level: low-risk or high-risk? You wanna make quick profits on the go or really want to be a sustained player? I dont think there is leverage system in stocks as in forex. So i guess anything less than 200k pkr wouldnt yield much. Again it depends on your budget and the strategy. But one caution: Think big, start small. I remember in forex there were virtual accounts to practice for atleast 6 months before investing a considerable amount. See if this is the case in stocks too? Depends on the broker. Even if not, study the market daily thinking like you are actually investing. The thing with forex and stock trading is: if you cannot manage 1$, you cannot manage 1million$. So practice lets say by assuming you have invested 10,000 pkr and then stick to the strategy and see where the market swings. Once you have tested your strategy which ofcourse you have altered time to time based on your learning, start doing investment with real money. One thing good is you are thinking at this stage to make some passive income. Thats brilliant idea. May be you should read "Rich dad, poor dad" book, it will help. Another book i'd recommend is "4 hours work week". They wont teach you about stocks, but will definitely teach you about the ideas of passive income and work-life culture. And lastly, you should constantly input more money every month or year, just compare in excel the compound interest (or profit) graphs. Don't just assume you will put some money and will gain on profits and re-investment. Good but also explore the power if you constantly flowing more money into your investments. Good luck!

-

WR1 joined the club

-

Minimum Investment and Return

UmarMakhzumi replied to Waqar Saleem's topic in PSX Stocks Investing's Topics

WS, There are different ways you can invest in PSX. The two common ones are: 1) By buying mutual funds 2) Open an account with a broker For Investing in mutual funds, you can head to any bank and ask them about what mutual funds they offer. Mutual funds are investment vehicle that allows pool of investors to buy group of stocks bundled in a single fund. Investment in mutual funds suits people who don't want to invest a large amount and would prefer a small percentage of their monthly income go towards investment (5-10% of Salary, You can even go higher or lower). Mutual funds usually have a fees 1-3% that is deducted from any profits. You can read more about investing in mutual funds here: https://www.dawn.com/news/1109126 . Meezan Bank has some very good index tracking mutual funds. You can check them out on their website if they would suit your needs. The second option of opening an account with a broker, requires you to do the trades. This is easy as well but remember to pick a top of the link broker as there is some history of broker fraud. Good brokers are Topline Securities, AKD Securities and any reputable bank that would offer these services. My broker is AKD. Every broker has a minimum capital investment requirement and charges they would deduct per stock trade. I think AKD requires a minimum investment of RS 100,000 (http://www.akdtrade.com). Once you open an account with a broker, you should also sign up for CDC. CDC is a body that protects investors incase of broker fraud. If you are signed up with CDC, your broker is required to copy CDC on each transaction. That means that CDC has a record of your investments and all investments in shares are safe. Anyway, when you invest by opening an account with a broker, you directly buy shares or sell them through your broker. They will provide you with a software which allows you to do that. It is very simple. In order to know which shares to buy, you will need to spend time to know the business in which you are investing. I can elaborate on that later after you have opened an account. Here are a few rules that I have invented that can help you with stock investment: Rule number 1 is that stock are only profitable if you invest your savings that you would not need to at least 3-5 years. If you have money set aside and you think that you will need that money in an year, don't invest in stocks. The reason being that stocks are very volatile and risky. It takes time for an investment to grow and produce returns. If your time frame is small, you are speculating the market not investing. Rule number 2 is that you can only make money in stocks if you buy them at a reasonable price. In order to know what a reasonable price is, you will need to look up company's financial statement and go through the numbers. It is very hard to make money in stocks if you don't buy them at a decent price. Rule number 3 is that never give your money to someone else to invest in stocks. If someone tells you that they would provide you with a guaranteed return of X thousands Rupees per month, that is a ponzi scheme. Stay away or you will lose your hard earned money. This rule is very important and applies to everyone esp people you have known for a long time. Rule number 4 is that never borrow money to invest in stocks. This is very dangerous. Borrowing to invest in stocks is pure speculation. Rule number 5 is read the book called The Intelligent Investor by Benjamin Graham. So if you follow the rules you will get a good return. I have even got 100%+ returns on some investments. The key is to keep reading stuff and do it yourself. Let me know should you have additional questions. Thanks. -

Salam i would like to ask how much minimum investment is required and what is the return rate? or what should be minimum amount to start investing in PSA for a reasonable return?

.thumb.jpg.51aee45d64f270ded062428cf8d8117e.jpg)

.thumb.jpg.700916fbc7ead330085e15745d0270bd.jpg)